(A) Income tax Rates for Individual & HUF, AOP, BOI & AJP

New Income tax slab rate for individual & HUF are introduced w.e.f FY 2020-21 but this new slab is optional for taxpayer, taxpayer may choose to pay tax at old slab rate. If tax payer want to opt for this new slab rate then he has to forego various deduction and exemption like deduction u/s 80C, standard deduction, NPS deduction u/s 80CCD(1b) but he may continue to avail exemption of allowance given under section 10(14) like conveyance allowance etc. As per provision of sec 115BAC , Assessee has the option to choose between NEW (Option A) and OLD (Option B) slab rate. (slab rate of both the options is given in below table)

- IF assessee is having no business income then this option shall be exercised for every year.

- IF assessee has business income, then option once exercised shall be valid for current & subsequent previous years.

- In the new Slab rate (Option A), slab rates are not differentiated on the basis of age group. Hence in new slab rate, same rate will be applied for individual aged above 60 or below 60 or above 80.

- New slab rate system (Option A) is only for individual & HUF. Hence in case of AOP, BOI and Artificial judicial person, old slab rate (Option A) will remain in only choice.

OPTION (A)-SLAB RATE UNDER NEW TAX Regime

W.e.f FY 2020-21, If an individual or HUF opt for new slab rate system i.e. new tax regime (option A) then following tax rates will be applicable for financial year 2020-21 (assessment year 2021-21):-

| Total Income | Rate of tax |

| Up to Rs. 2,50,000 | Nil |

| From Rs. 2,50,001 to Rs. 5,00,000 | 5% |

| From Rs. 5,00,001 to Rs. 7,50,000 | 10% |

| From Rs. 7,50,001 to Rs. 10,00,000 | 15% |

| From Rs. 10,00,001 to Rs. 12,50,000 | 20% |

| From Rs. 12,50,001 to Rs. 15,00,000 | 25% |

| Above Rs. 15,00,000 | 30% |

But If option given under 115BAC is exercised to choose New Slab rate (Option A ) then following deduction & exemption shall not be available to the taxpayers:-

- Leave travel concession as contained in clause (5) of section 10;

- House rent allowance as contained in clause (13A) of section 10;

- Some of the allowance as contained in clause (14) of section 10;

- Allowances to MPs/MLAs as contained in clause (17) of section 10;

- Allowance for income of minor as contained in clause (32) of section 10;

- Exemption for SEZ unit contained in section 10AA;

- Standard deduction, deduction for entertainment allowance and employment/professional tax as contained in section 16;

- Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

- Additional deprecation under clause (iia) of sub-section (1) of section 32;

- Deductions under section 32AD, 33AB, 33ABA;

- Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35;

- Deduction under section 35AD or section 35CCC;

- Deduction from family pension under clause (iia) of section 57;

- Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc). However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

- Set off of any loss,-carried forward or depreciation from any earlier assessment year, if such loss or depreciation is attributable to any of the deductions referred to in (a) above; or under the head house property with any other head of income; is not allowed.

BUT following allowances notified under section 10(14) of the Act to remain allowed to the Individual or HUF exercising option of NEW SLAB RATE (option A) under the proposed section:-

- Transport Allowance granted to a divyang employee to meet expenditure for the purpose of commuting between place of residence and place of duty

- Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

- Any Allowance granted to meet the cost of travel on tour or on transfer;

- Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

- deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment).

OPTION (B)-SLAB RATE UNDER OLD TAX Regime

IF an individual or HUF opt for OLD slab rate (OPTION B), there is no such restriction on exemptions & deductions as mentioned in OPTION (A) above and following slab rates are applicable:-

- Individual (resident or non-resident), who is of the age of less than 60 years on the last day of the relevant previous year:–

| Net income range | Income-Tax rate |

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001- Rs. 5,00,000 | 5% |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

- Resident senior citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year:–

| Net income range | Income-Tax rate |

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,001 – Rs. 5,00,000 | 5% |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

- Resident super senior citizen, i.e., every individual, being a resident in India, who is of the age of 80 years or more at any time during the previous year:–

| Net income range | Income-Tax rate |

| Up to Rs. 5,00,000 | Nil |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

- Slab rate for association of person (AOP), Body of individuals(BOI) and artificial judicial person (AJP). In case of AOP, BOI & AJP option to choose new slab rate system-OPTION-A is not available and following tax rates are applicable without any choice:-

| Net income range | Income-Tax rate |

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001- Rs. 5,00,000 | 5% |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Common Notes for New Tax Regime and Old Tax Regime:-

(1) Surcharge: – Surcharges is applicable at following rates:-

| Total Income | Rate of surcharge |

| Exceeds Rs. 50,00,000 but upto 1,00,00,000. | 10% of income tax |

| Exceeds Rs. 1,00,00,000 but upto 2,00,00,000. | 15% of income tax |

| Exceeds Rs. 2,00,00,000 but upto 5,00,00,000. | 25% of income tax |

| Exceeds Rs. 5,00,00,000. | 37% of income tax |

(2) Health and Education cess: – 4% of income tax and surcharge.

(3)Rebate under section 87A, A resident individual whose net income does not exceed Rs. 500000/- can avail rebate u/s 87A which is an amount equal to 100% of income tax or Rs. 12500/- whichever is less. Rebate u/s 87A is deductible from income tax before calculating education cess.

(4) If Net income exceeds Rs. 50 lakhs but does not exceeds Rs. 1 crore then surcharge @ 10% is applicable but if net income exceeds Rs. 1 crore then surcharge is applicable at the rate of 15% of income tax. Further surcharge is subject to marginal relief i.e amount payable as income tax & surcharge shall not exceed the total amount payable as income tax on total income of Rs. 50 Lakhs (or 1 Crore as the case may be) by more than the amount of income that exceeds Rs. 50 Lakhs ( or 1 crore as the case may be).

(5) Health and Education Cess” is 4% and it is to be levied on income tax & Surcharge. Surcharge is calculated on income tax before adding HEC. But HEC are calculated on income tax including surcharge if any.

(6) Alternate minimum tax: Tax payable cannot be less than 18.5% (+SC+EC+SHEC) of adjusted total income u/s 115JC. (Not applicable to those individual, HUF, AOP, BOI & AJP whose adjusted total income does not exceed Rs. 20 Lakhs AND who are not claiming any deduction u/s 10AA/ 35AD/ Chapter VI heading C-“deduction for certain incomes”.)

(7) A standard deduction of `50,000/- is allowed from salary income but this is in lieu of the earlier exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses.(Reimbursement by the employer for amount spent by employee for medical treatment of self or his family was exempt upto Rs. 15000/- in a year upto FY 2017-18 but this exemption is withdrawn from FY 2018-19 after introduction of standard deduction) However, the transport allowance at enhanced rate shall continue to be available to differently abled persons.

(8) W.e.f 1-4-2020 (FY 20-21), dividend distribution tax is abolished and dividend is made taxable in the hands of taxpayers at normal applicable rates. Dividend above Rs. 5000 is made subject to TDS @ 10% (TDS rate is 7.5% upto 31-3-2021)

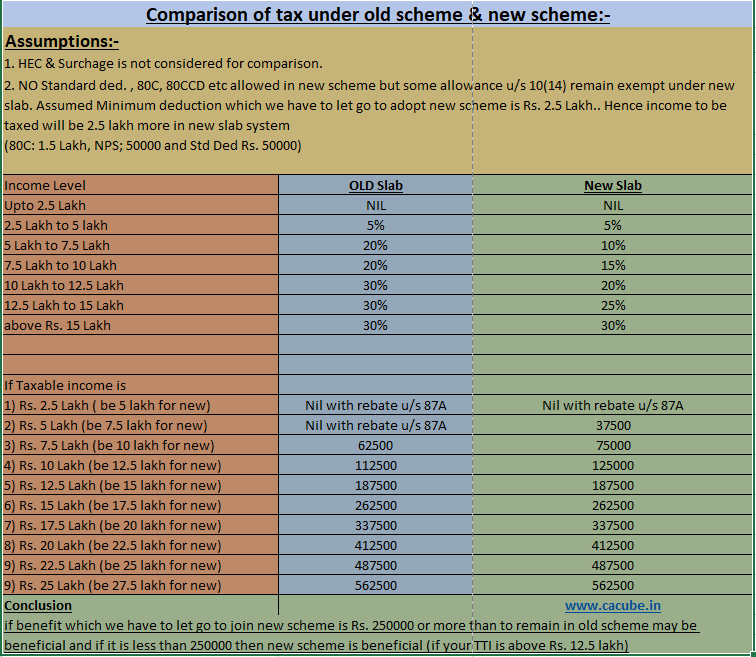

(8) Hence assessee is required to choose between old & new slab rates. Different decision may be useful for different assessees. Before taking any decision assessee should calculate his tax liability under both the options predicting his approximate income and then he has to choose the option in which his tax liability is less. A basic comparison of OLD & NEW tax regime is given here:-

(B) Income tax Rates for Firms

- For FY 2020-21, Income of Firms is taxable at the rate of 30%.

- Business under Proprietorship is not covered here, Income from Proprietorship is taxable in the hand of Proprietor in his Individual return under the head “PGBP – Profits & Gains of Business or Profession” .

- Surcharge:- In case income of firm exceeds Rs. 1 crore then surcharge @ 12% of income tax is applicable which is subject to marginal relief ie. The amount payable as income tax & surcharge shall not exceed the total amount payable as Income tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

- Health & Edu. Cess: 4% “Health and Education Cess” to be levied on the tax payable & Surcharge.

- Alternate minimum tax: Tax payable by firm cannot be less than 18.5% (+SC+EC+SHEC) of adjusted total income u/s 115JC.

(C) Income tax Rates for Companies

- Rate of income tax For FY 2020-21 for companies is as given below:

| Company | Category | Tax Rate |

|---|---|---|

| Domestic Company | (1) Domestic Company:-where total turnover or gross receipts during financial year 2018-19 does not exceed Rs. 400 crore. | 25% |

| (2) Where it opted for Section 115BA | 25% | |

| (3) Where it opted for Section 115BAA | 22% | |

| (4) Where it opted for Section 115BAB | 15% | |

| (5) any other domestic Company | 30% | |

| Foreign Company | (1) Royalty received form Government or Indian concern in pursuance of an agreement made by it after 31st march 1961 but before 1st April 1976 or fee for rendering technical services in pursuance of an agreement made by it after 29th February 1964 but before 1st April 1976 And where such agreement has been approved by Central Government. | 50% |

| (2) Other Income | 40% |

- Surcharge: If net income of a company does not exceed Rs. 1 crore, surcharge will be nil . For other cases, rate of Surcharge to be calculated on Income tax are given below:- (However Surcharges are subject to marginal Relief as under:-

- i)Where income exceeds Rs. 1 crore but not exceeding Rs. 10 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

- ii)Where income exceeds Rs. 10 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 10 crore by more than the amount of income that exceeds Rs. 10 crore)

| Company | If net income is more than Rs. 1 crore but not more than Rs. 10 crore. | If net income is more than Rs. 10 crore. |

|---|---|---|

| Domestic Company | 7% | 12% |

| Foreign Company | 2% | 5% |

- HEC: 4% “Health and Education Cess” to be levied on the tax & surcharge.

- A company is required to pay higher of the tax calculated under the following two provisions:

- Tax liability as per the Normal provisions of income tax act(as stated above)

- Tax liability as per the MAT provisions given in Sec 115JB(18.5 % of Book Profits plus HEC & surcharge if applicable. ( Note that Section 115JB of the Income-tax Act was amended by the Taxation Laws (Ordinance), 2019 (‘Ordinance’) to reduce the rate of MAT from 18.5% to 15% with effect from Assessment Year 2020-21.However, the Taxation Laws (Amendment) Bill, 2019, as tabled in the parliament on 25-11-2019, proposes to insert a proviso to section 115JB(1) that the rate of minimum alternative tax shall be reduced from 18.5% to 15% from previous year commencing on or after the April 1, 2020)

(D) Income tax Rates for Co-operative Societies

- Rates of income tax For FY 2020-21 for co-operative societies are as given below:

| Net Income Range | Rate of Tax |

|---|---|

| Upto Rs. 10000/- | 10% |

| Rs. 10000 to Rs. 20000 | 20% |

| Above Rs. 20000/- | 30% |

- Surcharge:- In case income of co-operative society exceeds Rs. 1 crore then surcharge @ 12% of income tax is applicable which is subject to marginal relief ie. The amount payable as income tax & surcharge shall not exceed the total amount payable as Income tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

- EC & SHEC: 4% “Health and Education Cess” to be levied on the tax & surcharge.

- Alternate minimum tax: Tax payable by co-operative society cannot be less than 18.5% (+SC+EC+SHEC) of adjusted total income u/s 115JC.

- The Finance Act, 2020 has inserted a new Section 115BAD in Income-tax Act to provide an option to the co-operative societies to get taxed at the rate of 22% plus 10% surcharge and 4% cess. The resident co-operative societies have an option to opt for taxation under newly Section 115BAD of the Act w.e.f. Assessment Year 2021-22. The option once exercised under this section cannot be subsequently withdrawn for the same or any other previous year.

- If the new regime of Section 115BAD is opted by a co-operative society, its income shall be computed without providing for specified exemption, deduction or incentive available under the Act. The societies opting for this section have been kept out of the purview of Alternate Minimum Tax (AMT). Further, the provision relating to computation, carry forward and set-off of AMT credit shall not apply to these assessees

- The option to pay tax at lower rates shall be available only if the total income of co-operative society is computed without claiming specified exemptions or deductions

(E) Income tax Rates for Local Authorities

- For FY 2020-21, Income of Local Authority is taxable at the rate of 30%.

- Surcharge:- In case income exceeds Rs. 1 crore then surcharge @ 12% of income tax is applicable which is subject to marginal relief ie. The amount payable as income tax & surcharge shall not exceed the total amount payable as Income tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

- Health & Edu. Cess:The existing 3% education cess is replaced by a 4% “Health and Education Cess” to be levied on the tax & surcharge.

- Alternate minimum tax: Tax payable cannot be less than 18.5% (+SC+EC+SHEC) of adjusted total income u/s 115JC.

(F) Income taxable at rate specified in Income tax Act. (Income taxable at special rates)

Following given are list of some important cases of income which is taxable at rates specified in Income-tax Act and not at rates mentioned above:-

| Section | Income | Income tax rate |

|---|---|---|

| 111A | Short term capital Gain (where STT applicable) | 15% |

| 112 | Long Term Capital Gain | 10% / 20% |

| 112A | Long Term Capital Gain in excess of Rs. 1 lakh | 10% |

| 115BB | Winning from lotteries, Crossword puzzles, race horse (excluding activity of owning & maintaining race horses), card games and other games of gambling | 30% |

| 115B | Profits & gains of Life insurance business | 12.5% |

Some important recent changes in income tax:-

- Limit of Rebate under section 87A is increased to Rs. 12500/- from 2500/- and Further condition of net taxable income for claiming the rebate is also increased to Rs. 500000/– from Rs. 350000/-. From Fy 2019-20, this rebate is available if total income of resident individual is upto Rs. 500000/-.

- Threshold limit u/s 194A, for deduction of TDS form interest other than interest on securities is increased to Rs. 40000/- from Rs. 10000/-. This limit was already increased to Rs. 50000/- for senior citizens.

- Threshold limit u/s 194I, for deduction of TDS form Rent is increased to Rs. 240000/- from Rs. 180000/- from FY 2019-20.

- Exemption u/s 54 extended to purchase /construction of two residential houses.

- Notional Rent on second self occupied house property is exempt from tax. refer section 23 & 24.

- In the Union Budget, 2017, corporate tax rate was reduced to 25% for companies whose turnover was less than `50 crore in financial year 2015-16. In Budget 2018, the benefit of this reduced rate of 25% also to companies who have reported turnover up to`250 crore in the financial year 2016-17. In Budget 2019, the benefit of this reduced rate of 25% also to companies who have reported turnover up to`400 crore in the financial year 2017-18.

- Long term capital gains ( arising from transfer of listed equity shares, units of equity oriented fund and unit of a business trust) exceeding `1 lakh shall be taxed at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31st January, 2018 will be grandfathered. For example, if an equity share is purchased six months before 31st January, 2018 at `100/- and the highest price quoted on 31st January, 2018 in respect of this share is `120/-,there will be no tax on the gain of `20/- if this share is sold after one year from the date of purchase. However, any gain in excess of `20 earned after 31st January, 2018 will be taxed at 10% if this share is sold after 31st July, 2018. The gains from equity share held up to one year will remain short term capital gain and will continue to be taxed at the rate of 15%.

- A standard deduction from salary income is increased to Rs. 50000/- from Rs. 40000/- but this is in lieu of the earlier exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses. However, the transport allowance at enhanced rate shall continue to be available to differently abled persons.

- Under section 44AB of the Act, every person carrying on business is required to get his accounts audited, if his total sales, turnover or gross receipts, in business exceed or exceeds one crore rupees in any previous year. In case of a person carrying on profession he is required to get his accounts audited, if his gross receipt in profession exceeds, fifty lakh rupees in any previous year. In order to reduce compliance burden on small and medium enterprises, it is proposed to increase the threshold limit for a person carrying on business from one crore rupees to five crore rupees in cases where,-

- aggregate of all receipts in cash during the previous year does not exceed five per cent of such receipt; and

- aggregate of all payments in cash during the previous year does not exceed five per cent.

- W.e.f 1-4-2020 (FY 20-21), dividend distribution tax is abolished and dividend is made taxable in the hands of taxpayers at normal applicable rates. Dividend above Rs. 5000 is made subject to TDS @ 10% (TDS rate is 7.5% upto 31-3-2021)

- 15% concessional rate of corporate tax extended to Power Sector.

- Cooperative societies provided an option to be taxed at 22 % with no exemption

- Faceless Appeals to be enabled in lines of faceless assessments

- PAN to be allotted instantly on basis on Aadhar