Income Tax Act 2025: Ultimate Change Guide – Full Section Mapping, Status Corrections, and Every Major Change Detailed

📜 Income Tax Act, 2025 – Ultimate Authoritative Guide The Income Tax Act, 2025 (ITA 2025), enacted via Presidential assent ...

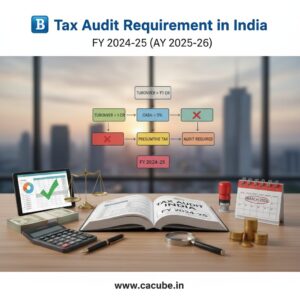

Tax Audit Requirement in India for FY 2024-25 (AY 2025-26)

Tax Audit Requirement in India for FY 2024-25 (AY 2025-26) 📘 Tax Audit Requirement in India for FY 2024-25 (AY ...

India’s Major GST Rate Cut: New Two-Slab Tax System in GST (w.e.f 22.09.2025)

India's Major GST Overhaul: A Comprehensive Guide to the 2025 Tax Changes GST Overhaul: A Comprehensive Guide to India's New ...

Finance Act 2025: Your Ultimate Guide to All Income Tax Changes for FY 2025-26

Finance Act 2025: Your Ultimate Guide to All Income Tax Changes Finance Act 2025: Your Ultimate Guide to All Income ...

Taxability of Income from House Property in India (FY 2024-25): Old vs New Tax Regime (along with historic changes)

House Property Taxation FY 2024-25: Old vs New Tax Regime, Deductions, Recent Changes – India Taxability of Income from House ...

Taxability of Capital Gains in India for FY 2024-25 (AY 2025-25) : Equity, Mutual Funds & Property Explained with Historic Changes

India Capital Gains Tax FY 2024-25: New Rules, Rates & Historic Changes Explained India's Capital Gains Tax for FY 2024-25: ...

ITR Filing FY 2024-25 (AY 2025-26): Your Essential Guide for Salaried Individuals – Avoid Mistakes & File Smart!

ITR Filing FY 2024-25 (AY 2025-26): Extended deadline is 15-09-2025 The Income Tax Return (ITR) filing season for Financial Year ...

Ultimate ITR Filing Guide for Salaried Individuals (FY 2024-25) | Avoid Tax Scrutiny & Navigate Tax Season Smoothly

ITR Filing Guide FY 2024-25: Avoid Tax Scrutiny for Salaried Individuals | [Your Website Name] Navigate Tax Season Smoothly: Your ...

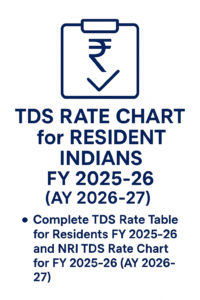

TDS Rate Chart for Resident and Non-Resident Indians FY 2025-26 (AY 2026-27) – Updated Rates and Key Changes

Complete TDS Rate Chart for Resident Indians FY 2025-26 (AY 2026-27) TDS Rate Chart for Resident Indians FY 2025-26 (AY ...

Reverse Charge Mechanism (RCM) under GST: Applicability, Categories, and Compliance

The Reverse Charge Mechanism (RCM) under the Goods and Services Tax (GST) system shifts the responsibility to pay tax from ...

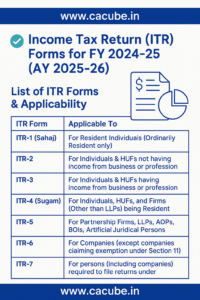

Complete List of Income Tax Return (ITR) Forms and Applicability for FY 2024-25 📋

Below is the complete list of Income Tax Return (ITR) forms applicable for filing returns for the Financial Year 2024-25 ...

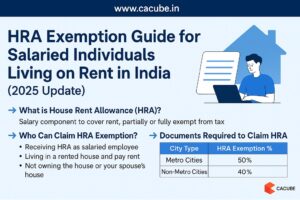

Unlock Savings: HRA Exemption Guide for Renters in India (2025 Update)

If you're a salaried employee living in rented accommodation, you may be eligible for a substantial tax benefit through the ...