Have you done tax planning for FY 2023-24 before the deadline 31st March 2024?- Checkout what you missed.

Financial year 2023-24 is reaching its end in a few days. 31st March is an important deadline with reference to ...

Highlights of Interim Budget 2024 (for FY 2024-25)

An interim budget is presented instead of a full budget in certain years due to the timing of general elections ...

Economic survey of India 2023-24 or The Indian Economy: A Review – January 2024 (Before Interim budget for FY 2024-25)

In an election year in India, the budget and economic survey presentation follow a different approach compared to a non-election ...

Threshold Limit & other aspect of GST Registration and RCM liability on purchase from Unregistered persons

Basics of GST Registration Every supplier whose annual aggregate turnover in the current financial year exceeds the threshold limits (as ...

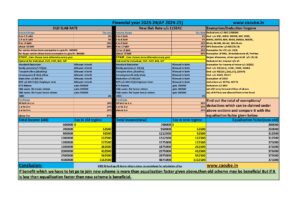

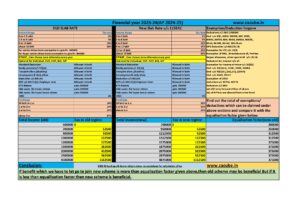

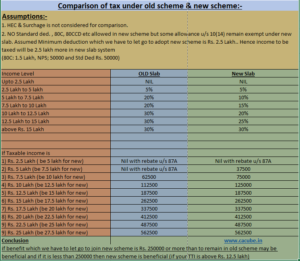

What to Choose: Old Slab Rate OR New Tax Regime as updated by Finance Budget 2023

In Budget 2023, some amendments are proposed for the new tax regime which was introduced in budget 2020 as an ...

Have you done tax planning for FY 2022-23 before the deadline 31st March 2023?- Checkout what you missed.

Financial year 2022-23 is reaching its end in a few weeks. 31st March is an important deadline with reference to ...

List of 136 incomes on which tax is not required to be paid in India. (Complete List of exempt income along with sections and conditions)

Generally when any person (Individual, HUF, AOP, BOI, AJP, Firm, Company or trust etc.) earn any income, then some part ...

Advance tax: Are you required to pay Advance tax? What are consequences for not paying Advance tax?

Do you know what is the due date for payment of Income tax for a financial year. ? With the ...

Important Highlights of Tax Proposals in Union Budget 2022 (FY 2022-23)

Today, i.e. 1st February 2022, Finance Minister of India presented Union budget 2022 . The Finance bill is the part ...

Have you done tax planning for FY 2021-22 before the deadline 31st March 2022- Checkout what you missed.

Financial year 2021-22 is reaching its end in a few weeks. 31st March is an important deadline with reference to ...

Clarifications/Guidelines regarding TDS u/s 194Q (applicable w.e.f 1.7.2021, TDS on payment for purchase of goods above threshold limit of Rs. 50 Lakhs by a buyer whose turnover is exceeding Rs. 10 crores in preceeding FY) and TCS u/s 206C(IH) and TDS u/s 194-O issued vide circular no. 13 dt. 30.06.2021

Applicability of 194Q A new section 194Q was inserted by Finance Act 2021 for deducting tax at source. This section ...

Have you done financial planning for 2020-21 before the deadline 31st March 2021 – Check out what you missed.

Financial year 2020-21 is reaching to its ends in few days. 31st March is an important deadline with reference to ...

List of GST Returns and their Due date of Filing

GST Returns and their Due dates Due date for filing of GST return and Default due date for payment of ...

Important Highlights of Tax Proposals in Finance Budget 2021-22

The Finance Minister, Nirmala Sitharaman presented her third Union budget 2021 in Parliament today i.e. 01-02-2021. Following are important proposals ...

Taxability of Mutual Fund: Is your mutual fund taxable or exempt?

Investment is a good habit to make our future more independent. Keeping some part of our money to get more ...

GST important Due dates for Financial year 2020-21

GST important Due dates for Financial year 2020-21 (A) Default Due date for filing of GST return and Default due ...

GST 39th Council Meeting Update:- GST on mobile phone and parts increased to 18% and Deadline for GST filing extended.

39th Meeting of GST council held in New Delhi today. Some of highlights are given below:-. It was decided to ...

GST important Due dates for Financial year 2019-20

GST important Due dates for Financial year 2019-20 (A) Default Due date for filing of GST return and Default due ...

Important Highlights & Tax Proposals of Finance Budget 2020-21

Important Highlights & Tax Proposals of Finance Budget 2020-21 The Finance Minister, Nirmala Sitharaman presented his second Union budget 2020 ...

Have you done financial planning for 2019-20 before the deadline 31st March 2020/30th July/ 30th September – Check out what you missed and what are relief measures provided by FM in view of Covid19 (Coronavirus) Outbreak.

Have you done financial planning for 2019-20 before the deadline 31st March 2020/30th July 2020/30th September 2020 - Check out ...

TDS is introduced in GST w.e.f. 01.10.2018: All about TDS in GST Law

TDS is introduced in GST w.e.f. 01.10.2018: All about TDS in GST Law GST Law mandates Tax Deduction at Source ...

All About Reverse Charge Mechanism of Goods & Services in GST.

All about Reverse charge Mechanism In GST. What is Reverse Charge Normally Supplier of goods or services is liable to ...

Updates relating to GST return, Income Tax and SEBI.

CBDT has released parameters for manual selection of Income Tax Returns for Complete Income Tax Scrutiny during financial year 2018-19 ...

Last date of filing GSTR-3B for the month of July, 2018 has been extended to 24th Aug, 2018.

As per GST Portal, Last date of filing GSTR-3B for the month of July, 2018 has been extended to 24th Aug, 2018. Official Order is ...

Clause 30C & 44 of Tax Audit report is kept in abeyance till 31st march 2019

On 17th August 2018, CBDT issued order under section 119 of Income Tax Act 1961 that reporting under clause 30C ...

In A New Record, Rs 10.03 Lakh Crore Collected As Income Tax In 2017-18

In a new record, Income Tax worth Rs 10.03 lakh crore was collected during 2017-18, the Central Board of Direct ...

Due date of GSTR-1 Extended to 11th of next month till March 2019

Due dates for filing GSTR 1 for all months from July 2018 till March 2019 has been extended to 11th ...

Due date Calendar for August 2018

Statutory and Tax Compliance Calendar for August 2018 S.No Particulars of Compliance Forms/returns Due Date Compliances Calendar for GST 1 ...

Key points of 29th Meeting of GST Council held on 4th August 2018

Summary of GST meeting 4th August 2018: 1. GOM for MSME Issues: a. GST Council constitutes a Group of Ministers ...

Key Features of Draft GST simplified returns formats issued by CBIC on 30th July 2018.

The GST Council in its 28th GST Council Meeting held on July 21, 2018 under the Chairmanship of Shri Piyush Goyal, ...

An Overview of Tax Audit U/s 44AB of Income tax Act.

Tax Audit under section 44AB was introduced by Finance Act 1984, w.e.f. 1st April 1985 (A. Y. 1985-86). The main ...

How to File Income Tax Return for F&O Trading and Speculative transactions in FY 2017-18 (AY 2018-19)

Most of Salaried Employees are involved in derivative trading (trading in future and options or F&O on stocks, currencies, and ...

Updates of 28th GST Council meeting held on 21st July 2018

28st GST Council meeting held on 21st July 2018 and we are presenting here the key decisions taken in this ...

28th GST Council meet on Saturday i.e. 21st July 2018: Return simplification, law tweaks, setting up of tribunal on table

28th GST Council meet on Saturday i.e. 21st July 2018: Return simplification, law tweaks, setting up of tribunal on table ...

GST important Due dates for Financial year 2018-19

GST important Due dates for Financial year 2018-19 (A) Due date for payment of GST (From 01-04-2018 to 31-03-2019) Taxpayer ...

Due date Calendar for July 2018

Due dates for the month of July 2018. GSTR-3B (Jun 2018)-Jul 20th, 2018 GSTR-5 (Jun 2018)-Jul 20th, 2018 GSTR-6 (Jul'17 ...

Due date Calendar for June-2018

(A) Due dates for Compliances under GST for the Month of June 2018 10-06-2018- Due date for filing GSTR -1 for the ...

Reverse Charge Mechanism further postponed till 30.09.2018 for Unregistered Person.

Section 9 (4) of the Central Goods and Services Tax, 2017 (CGST Act in short) and Section 5(4) of Integrated ...

Have you done financial planning for 2017-18 before the deadline 31st March 2018 – Check out what you missed?

Financial year 2017-18 is reaching to its ends in few weeks. 31st March is an important deadline with reference to ...

Job Work under GST: Taxability & Compliance

What is Job Work? Any treatment or process undertaken by a person on goods belonging to another registered person is ...

E-Way Bill: All about compliance requirement of E-Way Bill w.e.f 1st April 2018.

What is E-Way Bill? E-way bill is an electronic document generated online from E-way bill portal (https://ewaybillgst.gov.in/) which is required ...

Important GST updates vide recent GST notifications dt. 28th March 2018

Important GST updates vide recent GST notifications dt. 28th March 2018: Due date for filing GSTR-6 for the period of ...

GST due dates for FY 2017-18

GST important Due dates for Financial year 2017-18 (A) Due date for payment of GST (From 01-07-2017 to 31-03-2018) Taxpayer ...

26th Meeting of GST Council: E-Way bill mandatory w.e.f. 1st April & GSTR-3B continued.

26th Meeting of GST council held today i.e 10th March 2018 in New Delhi under chairmanship of Sh. Arun jaitley ...

Government Simplifies E-Way Bill Rules just two days before 26th meeting of GST Council.

Under GST regime, an e-waybill needs to be generated and carried for movement of goods above rupees 50000. Previously on ...

Income Tax Dept. probes Rs. 1000 crore tax refund fraud by Govt. and PSU employees.

Belated or revised income tax return for the financial year 15-16 or 16 17 can be filed up to 31st ...

E-Way bill for movement of Goods: Target Dates

Under GST regime, an e-waybill needs to be generated and carried for movement of goods above rupees 50000. Previously on ...

E-way bill may start from 1st April-2018:Meeting of GOM

On 24-02-2018, in the meeting of GoM (Group of Ministers), it is decided to start the inter-state movement of goods ...

Date of Compulsory E-Way Bill Postponed.

To facilitate easy inter-state movement of goods throughout the country, National E-way bill was made compulsory w.e.f. 01-02-2018 for consignment ...

Important Highlights & Tax Proposals of Finance Budget 2018-19

Important Highlights & Tax Proposals of Finance Budget 2018-19 The Finance Minister, Sh. Arun Jaitley presented his fifth Union budget ...

Long Term Capital Gain is made taxable @ 10% w.e.f 1st April 2018

As proposed in budget 2018, w.e.f. 01-04-2018 Long term capital gains (from equity or units of MF) exceeding Rs. 1 ...

Composition Scheme in GST: Updated with 23rd meeting of GST Council

Composition Scheme in GST: Updated with 23rd meeting of GST Council Composition Scheme is introduced to give relief to small taxpayer ...

23rd GST Council meet: Only these 50 items under 28% slab w.e.f 15th November 2017

23rd GST Council meet held on 10th November 2017 in Guwahati. This 23rd meeting came up with new decisions to ease ...

Due Date for Filing GST Return and making Payment Under GST: Updated with 23rd meeting of GST council held on 10th November 2017

Due Date for Filing GST Return and making payment of GST We have received many queries regarding GST Return and ...

Works Contract in GST Regime

Works Contract in GST Regime As we all know, GST is going to be implemented w.e.f 01-07-2017, We have already ...

GST Concepts/Basic Features of GST

GST Concepts/Basic Features of GST GST Law as going to be implemented in India w.e.f 01.07.2017, have following features:- State-wise ...

Critical Analysis of Benefits of GST

Critical Analysis of Benefits of GST Government is advertising benefits of GST since few months. Here in this blog we ...

Making of GST Law in India

Making of GST Law in india As we all are aware that Government has decided to implement GST w.e.f 1st ...

Highlights of Union Budget 2017-18

Key Highlights of Union Budget 2017-18 Today on Date 1st February 2017, Finance Minister, Mr. Arun Jaitley presented Union Budget ...

Secret Informer of Tax Department and Annual Information Return

Secret Informer of Tax Department and Annual Information Return (AIR): To curb black money, government need secret informer and to ...

File your Income tax Return: FAQ AY 2016-17

Income tax Return AY 2016-17 Q 1. What are the modes of filing return of income? Return of income can ...

Accounting code for payment of KKC

Accounting code for payment of KKC notified by CBEC The CBEC vide Circular No. 194/04/2016-ST dt. 26 May 2016 has ...

Things to know about Goods and Service Tax(GST):Model GST Law

Things to know about Goods and Service Tax(GST) On June 14, 2016 the Finance Ministry has released the 'Model GST ...

History of Service tax Rates and How to find which rate will apply?

History of Service Tax Rates History of Service Tax Rates since 01-07-1994 till date... From TO Rate EC on ST ...

Provident Fund in India, Its Taxability and TDS on Provident Fund

Provident Fund in India, Its Taxability and TDS on Provident Fund What is the Provident Fund(PF)? Provident Fund is a ...

Krishi Kalyan Cess (KKC) @ 0.5% introduced (from 1st June 2016)

Krishi Kalyan Cess (KKC) @ 0.5% introduced (from 1st June 2016) It is the time to face new cess named ...

Calculation of Service Tax on Works Contract

We have received many queries regarding Calculation of Service tax on Works Contract Service. Here in this blog, a short ...

India-Mauritius Tax treaty revised to curb Black Money

India-Mauritius Tax treaty revised to curb Black Money On date 11-05-2016, India getting Mauritius to sign a revised India-Mauritius tax ...