In Budget 2023, some amendments are proposed for the new tax regime which was introduced in budget 2020 as an optional reduced slab rate u/s 115BAC. The option of the reduced slab rate was available only to Individuals & HUF. But to opt for this option of reduced slab rate, assesses have to forgo some exemptions and deductions. To read more detail about the applicability of rates for FY 2022-23 Click here.

Budget 2023, proposed the following 7 changes to the New tax regime of reduced slab Rate:-

- The new tax regime for Individual and HUF, introduced by the Finance Act 2020, is now proposed to be the default regime.

- This regime would also become the default regime for AOP (other than co-operative), BOI, and AJP.

- Any individual, HUF, AOP (other than co-operative), BOI or AJP not willing to be taxed under this new regime can opt to be taxed under the old regime. For those persons having income under the head “profit and gains of business or profession” and having opted for old regime can revoke that option only once and after that, they will continue to be taxed under the new regime. For those not having income under the head “profit and gains of business or profession”, the option for the old regime may be exercised in each year.

- Substantial relief is proposed under the new regime with new slabs and tax rates as under:

- Upto 300000 : Tax rate NIL

- From 3,00,001 to 6,00,000 : 5%

- From 6,00,001 to 9,00,000 : 10%

- From 9,00,001 to 12,00,000 : 15%

- From 12,00,001 to 15,00,000 : 20%

- above 1500000 : 30%

- Resident individual with total income up to Rs. 5,00,000 do not pay any tax due to rebate under both old and new regime. It is proposed to increase the rebate for the resident individual under the new regime so that they do not pay tax if their total income is up to Rs. 7,00,000.

- Standard deduction of Rs. 50,000 to salaried individuals, and a deduction from family pensions up to Rs. 15,000, is currently allowed only under the old regime. It is proposed to allow these two deductions under the new regime also.

- Following change in proposed in Surcharge on income-tax under in new tax regime :-

- 10 per cent if income is above Rs. 50 lakh and up to Rs. 1 crore

- 15 per cent if income is above Rs. 1 crore and up to Rs. 2 crore

- 25 per cent if income is above Rs. 2 crore

- No change in surcharge is proposed for those who opt to be under the old regime. (where 37% surcharge if income above Rs. 5 crore)

What to Choose:- New tax Regime (Reduced new slab rate) or Old Tax Regime ?

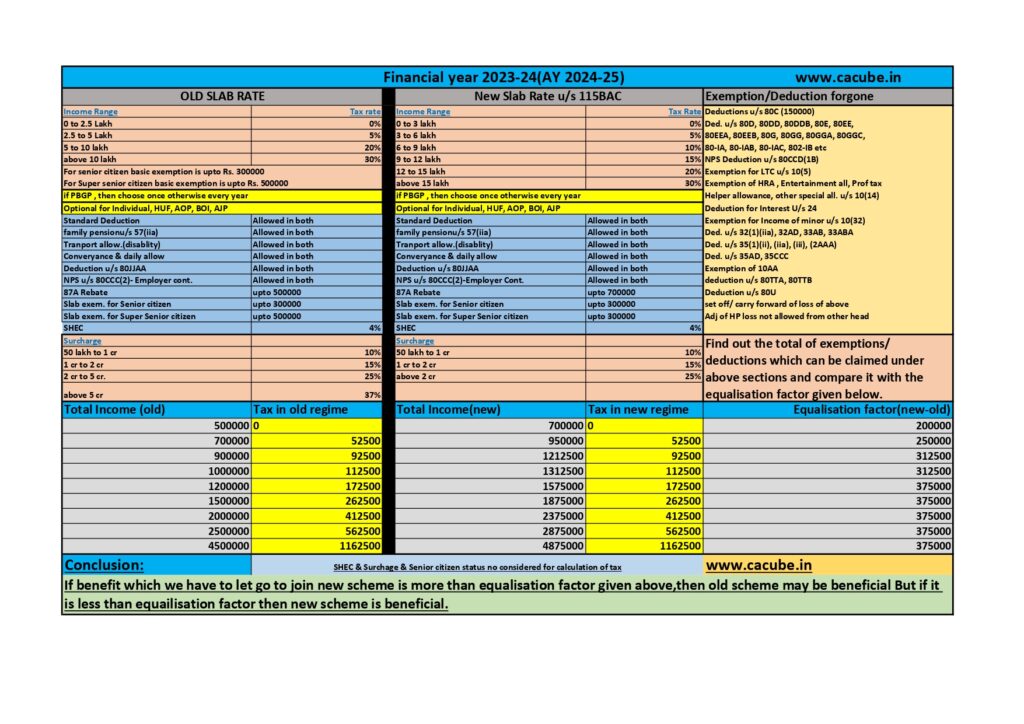

A brief comparison of the new & old tax regimes for FY 2023-24 is given in the image.. If the benefit which we have to let go to join the new scheme is more than the equalization factor given above, then the old scheme may be beneficial But if it is less than the equalisation factor then the new scheme is beneficial.

Following deductions/exemption are not allowed in New Tax regime for FY 2023-24-

- Deductions u/s 80C (Contribution to PPF, PF, LIC premium etc.) maximum Rs. 150000/-

- Dedutions U/s 80CCD(IB) (Employee Contribution to NPS) maximum Rs. 50000/-

- Deductions u/s 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GGA, 80GGC, 80IA, 80IAB, 80IAC, 80IB, 80TTA, 80TTA, 80U etc.

- Exemption for LTC u/s 10(5)

- Exemption for HRA.

- Exemption of Entertainment Allowance.

- Exemption of Professional tax.

- Exemption of Helper allowance, Washing Allowance and otehr special allowances u/s 10(14)

- Deduction of interest u/s 24.

- exemption of income of minor child u/s 10(32)

- Deductions u/s 32(1)(ii), (iia), (iii), (2AAA), 35AD, 35CCC.

- Exemptions of 10AA.

- Deductions u/s 80TTA, 80TTB.

- Deductions u/s 80U.

- Benefit of higher basic exemption limit of Rs. 500000/- for super senior citizen is also not allowed under new tax regime.

- Set-off / carry forward of any loss of above is also not allowed.

- Adjustment of House property loss from other income heads is also not allowed.

Following deductions/exemption are kept allowed in New Tax regime for FY 2023-24-

- Standard deduction from salary for Rs. 50000/-

- Deduction for family pension u/s 57(iia)

- Transport allowance exemption for disabled employee.

- Conveyance & daily allowance exemption.

- Deduction u/s 80JJAA

- NPS u/s 80CCD(2) Employer contribution to NPS.

- Rebate u/s 87A is increased for taxable income upto Rs. 700000/- from Rs. 500000/- only for assessee who are in new tax regime.

- Surcharge is restricted to 25% for income above 2cr. only for assesee in new tax regime.

A brief comparison of the new & old tax regimes for FY 2023-24 is given in the image.. If the benefit which we have to let go to join the new scheme is more than the equalization factor given above, then the old scheme may be beneficial But if it is less than the equalisation factor then the new scheme is beneficial.