Financial year 2023-24 is reaching its end in a few days. 31st March is an important deadline with reference to Financial Planning and Tax Planning, missing it may result in higher tax liability. We are required to complete our tax planning before 31st march 2024, as we are required to file Income tax return for FY 2023-24 during 2024-25. For claiming many deductions and exemptions in our income tax return, we need to take the right step before 31st march 2024. So if you have not completed your tax planning for FY 2023-24 you are left with a few days only. For your reference, given below is the list of some important financial decisions which are required to be taken before 31st march 2024.

Decision regarding Capital Gain Planning

We know that all long term capital gains (covered under STT) were exempt u/s 10(38) upto 31-3-2018 but long term capital gain (covered under STT) above Rs. 100000/- are made taxable @10% from 01.04.2018. Other long terms capital gain (other than equity) are taxed @20% with indexation. Further Short term capital gain (covered under STT) are taxed @15% and other short term capital gain (other than equity) are taxed as per slab rate.

In case you have a capital loss , that can be carried forwarded to limited number of years (8 years) for adjusted with future capital gains. Now Review your portfolio for tax planning on capital gain. For example if in your return you have carried forwarded any short term capital loss which is allowed to carry forward only upto 8 assessment years. If this is your 8th year, review your portfolio any if any short term capital gain is available, sell the shares and book short term capital gain to adjust carried forwarded short term capital loss(STCL) otherwise this will lapse. You can buy your shares again by paying marginal brokerage which you have to bear. But remember that sell and buy transaction should not be done on the same day.

Further if you have capital gain in current year 2023-24, on which you need to pay tax. But if in your portfolio some shares which are currently in loss then you can sell these shares to book loss so that you need not pay any tax on current year gain as it will be adjusted against the loss booked now. You can again buy these shares next day. Through this planning, You can save tax on capital gain.

Decision regarding Investment to claim deduction U/s 80C

IF you are in Old tax Regime then you can claim a deduction of Rs. 150000/- u/s 80C, it means An Individual or HUF can reduce your total taxable income up to Rs 1,50,000 from through section 80C. Section 80C provides list of investments/ expenditures which is allowed as deduction. If you are short of limit u/s 80C, you are left with only few days to consider option best suitable to you, by investing in these you will get deduction u/s 80C from upto Rs. 150000/-. List of some important investment deductible u/s 80C is given below:

- PPF (Public Provident Fund)

- EPF (Employees’ Provident Fund)

- 5 years Bank or Post office Tax saving Deposits

- National Savings Certificates (NSC)

- ULIPs

- ELSS Mutual Funds (Equity Linked Saving Schemes)

- Children’s Tuition Fees

- Life Insurance Premium

- Sukanya Samriddhi Account Deposit Scheme

- SCSS (Post office Senior Citizen Savings Scheme)

- Repayment of Home Loan (Principal only)

- Subscription to deposit scheme of a public sector or company engaged in providing housing finance

- Contribution to notified Pension Fund.

- National Pension System

- NABARD rural Bonds

- Contribution to notified annuity Plan of LIC.

For FY 2023-24 the cutoff date for these investment is 31st march 2024 but if you are employed then your employer may have asked you to submit your detail for deduction u/s 80C before Feb-24 or march-2024 so that your TDS can be deducted accordingly and any access or less deduction in earlier months can be adjusted in the salary for the month of march-2024.

Decision regarding contribution to NPS u/s 80CCD(1B)

If you are in OLD tax regime, U/s 80CCD(1B) a deduction of Rs 50,000 can be claimed which is over & above the limit of Rs. 150000/- u/s 80C. If you are in 30% Tax bracket then making an contribution to NPS is going to save immediate Rs. 15000/- of your tax. You may decide to open an NPS account if you have not opened earlier or you may decide contribute to earlier opened account. To get deduction under section 80CCD(1D) for FY 2023-24, you need to make contribution before 31st March 2024. You need to submit the contribution receipts to your employer to get the benefit of 80CCD(1B) in form-16.

Decision regarding continuity of social security schemes.

If you have chosen to invest in any social security schemes like Public Provident Fund (PPF), National Pension Scheme(NPS) or Sukanya Samridhi Yojana (SSY) etc. which requires a minimum amount to be deposited in every year to keep them active. If you forgot to invest the minimum amount in these schemes, then you have to pay a penalty along with unpaid amount to make the scheme active again. Make sure that you have deposited at least minimum amount before 31st march 2024.

31st March 2024 is last date to file belated Income tax return(ITR) u/s 139(4) and revised ITR u/s 139(5) for FY 2022-23 (AY 2023-24)

If you have not filed your income tax return for financial year 2022-23 or you want to revise your income tax return for 2022-23 (only if assessment is not yet completed) then it is last chance for you because 31st March 2024 is the last date to file your belated or revised income tax return for the FY 2022-23 (AY 23-24)

As per section 139(4):-

- upto to FY 2015-16- belated return could be filed at any time before completion of one year from the end of assessment year or before completion of assessment whichever is earlier.

- From FY 2016-17- belated return can be filed at any time before the end of assessment year or before completion of assessment whichever is earlier.(from FY 2016-17, a belated return can also be revised)

As per section 139(5):-

- upto to FY 2016-17- revised return could be filed at any time before completion of one year from the end of assessment year or before completion of assessment whichever is earlier.

- From FY 2017-18- revised return can be filed at any time before the end of assessment year or before completion of assessment whichever is earlier.

31st March 2024 is the last date for filing updated return for FY 2020-21

In Budget 2022, The concept of updated return was introduced. An “Updated Return” can be filed within two year from the end of relevant assessment year. Some taxpayers may realize that they have committed omissions or mistakes in correctly estimating their income for tax payment. Updated Return will provide an opportunity to correct such errors, Assessee can file an Updated Return on payment of additional tax. 31st March 2024 is the last date for filing updated return for FY 2020-21 by paying additional tax.

Payment of tax liability including Advance tax.

If your tax liability is more than Rs. 10000/- then make sure that you have paid all tax dues as advance tax. If any sum is pending make sure that it is deposited before 31st march 2024 to reduce your interest liability u/s 234B. For delayed payments of advanced tax interest u/s 234B & 234C are charged.

Interest u/s 234C on last installment if you forgot to pay 100% of your advance tax till 15th March then if you

- If you pay this on 16th march:- Interest u/s 234C @1% for one month and no interest u/s 234B.

- If you pay on 31st March;- Interest u/s 234C @1% for one month and no interest u/s 234B.

- If you pay this on 1st April:- Interest u/s 234C @1% for one month only and interest u/s 234B is 1% for one month.

- If you pay this on 15th May;- Interest u/s 234C@1% for one month only and interest u/s 234B is 1% for two months (being 2% in total).

- If you pay this on 31st July (at the time of ITR filing):- Interest u/s 234C @ 1% for one month only and interest u/s 234B is 1% for four months (being 4% in total).

Interest 234C is for the period upto 31st march for default in payment of advance tax as per installment schedule. Interest u/s 234C is not charged for after 31st march of same financial year. It tax is not paid even upto 31st march then interest w.e.f 1st April till the actual payment of tax covered by section 234B which is charged @1% per month or part of month.

Click here for Due date for payment of tax for FY 2023-24 (AY 2024-25)

Furnishing detail of other income and Investment to your Employer

Salaried Individuals are required to furnish their details of other income and Investment to their employer so that this detail is considered by your employer while deducting tax at source. Different employer provides different time limit for furnishing such detail. But employer may consider your detail, before deducting tax at source in respect of last month of financial year i.e. march-2024 depending on procedures required to be followed. If you have not furnished such detail to employer then ask your employer and do it immediately. Due date for issuance of Form 16 by employer for FY 2023-24 is 31st May 2024.

Decision regarding other deduction available u/s 80D, 80DDB etc.

U/s 80D , If you paid your Health insurance premium for mediclaim policy for Self, Spouse or dependent children is tax deductible upto Rs 25,000. If any one of the persons specified is a senior citizen and Mediclaim Insurance premium is paid for such senior citizen then the deduction amount now is Rs. 50,000. Additional deduction for Health Insurance premium paid for parents is tax deductible upto Rs 25,000. If your parents are senior citizens then the maximum allowable deduction is Rs 50,000. In case, both taxpayer and parent(s) are 60 years or above, the maximum deduction available under this section is up to Rs.1 lakh.

U/s 80DDB, A deduction Rs. 40,000/- or amount actually paid on himself or dependent relative for medical treatment of specified disease or ailment, is available. The diseases have been specified in Rule 11DD. In case the individual on behalf of whom such expenses are incurred is a senior citizen, the individual or HUF taxpayer can claim a deduction up to Rs 1 lakh. Until FY 2017-18, the deduction that could be claimed for a senior citizen and a super senior citizen was Rs 60,000 and Rs 80,000 respectively. This has now become a common deduction available upto Rs 1 lakh for all senior citizens (including super senior citizens) unlike earlier.For example, If person is under 20% slab rate who will be under 30% slab next year.

Decision regarding LTC for FY 2023-24

Generally LTC exemption is allowed for travel expenditure of employees twice in a span of four year. In view of the Covid-19 pandemic and resultant nationwide lockdown as well as disruption of transport sector a number of employees were not able to avail of Leave Travel Concession (LTC) in the last Block of four years (calendar years 2018-2019-2020-2021) (As we know that In LTC, Two Journeys are allowed in a block of 4 years) Hence LTC cash voucher scheme was announced by the Government of India, under which lncome-tax Exemption was allowed the for deemed LTC fare to the Central Government Employees for 1/3 value of purchase of goods or services (with GST rate 12% or more) for the period 12th October 2020 to 31st March 2021, subject to fulfilments of certain conditions.

The current block of four year is 2022-2023-2024-2025. For the FY 2023-24, If you have performed a journey in calendar year 2023 or 2024 but upto 31-03-2024, then you can submit your application to your employer and get it approved before 31-3-2024 so that exemption benefit can be availed.

Decision regarding VPF (Voluntary contribution to EPF)

In Budget 2021, In order to rationalize tax exemption for the income earned by high income employees, it was proposed to restrict tax exemption for the interest income earned on the employee’s contribution to various provident funds to the annual contribution of Rs. 2.5 lakh. This restriction shall be applicable only for the contribution made on or after 01.04.2021 i.e. FY 21-2022 .

In Budget 2020. As per the announcement made, if an employer’s total contribution to the EPF, NPS and superannuation fund exceeds Rs 7.5 lakh in a financial year, then the excess contribution will be taxable in the hands of an employee. Further, any interest earned on the excess contribution is taxable as well. This was effective from FY 2020-21 i.e. April 1, 2020.

Upto 31st March 2021, Interest on RPF (Recognized Provident Fund) was exempt upto 9.5%. and interest exceeding 9.5% is taxable. On maturity (if minimum service period of 5 year is met except in case of ill health or discontinuance of business) the whole amount is exempt. But w.e.f 1st April 2021 the exemption is restricted to interest on employee contribution upto Rs. 250000/-.

Now you can review your total contribution to EPF (employee contribution) in FY 2023-24 and if it is far less than Rs. 250000/- then you may decide to make additional VPF contribution so that total employee contribution in FY 2023-24 become closer to Rs. 250000/- to take full benefit of exempt interest at interest rate higher than FD.

Please note that interest on employee contribution above Rs. 250000/- is made taxable w.e.f 1st April 2021.

Ensure that you have you have done respective expenditure/investment before 31st March-2024 to claim deduction under chapter-VI-A.

Others

- Home Loan Repayment: If you have a home loan, the principal repayment qualifies for deduction under Section 80C, and the interest payment qualifies for deduction under Section 24. Make sure your records are updated to claim these deductions.

- Education Loan Interest Payment: Interest paid on education loans is eligible for deduction under Section 80E. Ensure that you have the necessary certificates from your bank or financial institution to claim this deduction.

- Donations: Contributions to approved charitable institutions can be claimed as a deduction under Section 80G. Ensure that you have the receipt of the donation with the PAN of the donee institution for claiming deduction.

What to choose in old & New Tax regime for FY 2023-24 (AY 2024-25)?

In Budget 2023, some amendments are proposed for the new tax regime which was introduced in budget 2020 as an optional reduced slab rate u/s 115BAC. The option of the reduced slab rate was available only to Individuals & HUF. But to opt for this option of reduced slab rate, assesses have to forgo some exemptions and deductions.

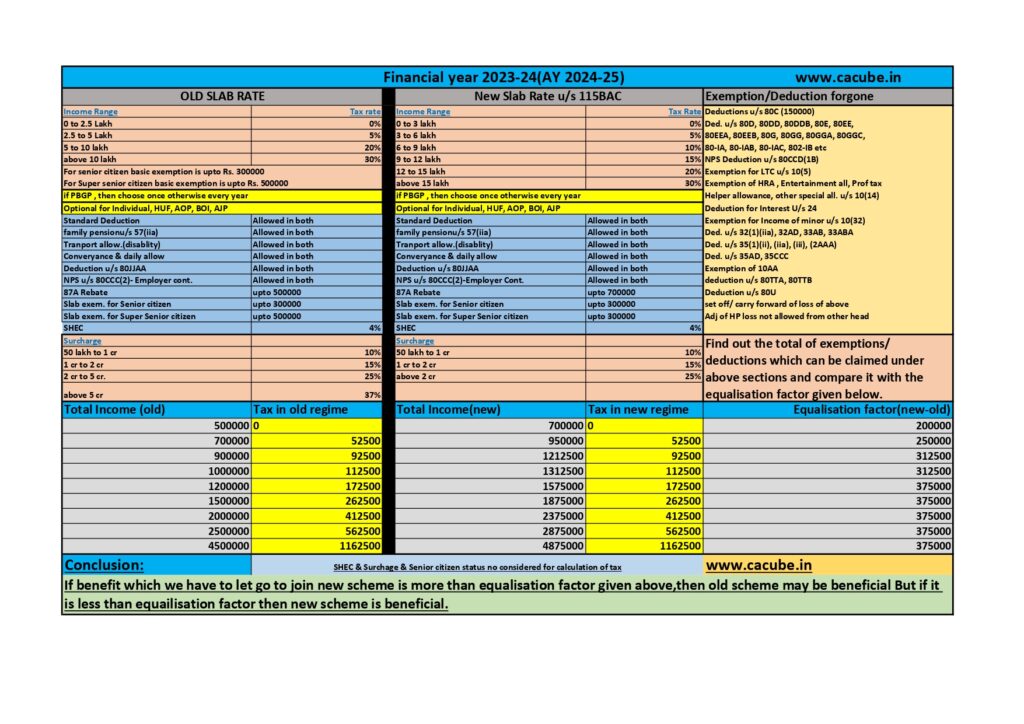

A brief comparison of the new & old tax regimes for FY 2023-24 is given in the image.. If the benefit which we have to let go to join the new scheme is more than the equalization factor given above, then the old scheme may be beneficial But if it is less than the equalisation factor then the new scheme is beneficial.

Following deductions/exemption are not allowed in New Tax regime for FY 2023-24-

- Deductions u/s 80C (Contribution to PPF, PF, LIC premium etc.) maximum Rs. 150000/-

- Dedutions U/s 80CCD(IB) (Employee Contribution to NPS) maximum Rs. 50000/-

- Deductions u/s 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GGA, 80GGC, 80IA, 80IAB, 80IAC, 80IB, 80TTA, 80TTA, 80U etc.

- Exemption for LTC u/s 10(5)

- Exemption for HRA.

- Exemption of Entertainment Allowance.

- Exemption of Professional tax.

- Exemption of Helper allowance, Washing Allowance and otehr special allowances u/s 10(14)

- Deduction of interest u/s 24.

- exemption of income of minor child u/s 10(32)

- Deductions u/s 32(1)(ii), (iia), (iii), (2AAA), 35AD, 35CCC.

- Exemptions of 10AA.

- Deductions u/s 80TTA, 80TTB.

- Deductions u/s 80U.

- Benefit of higher basic exemption limit of Rs. 500000/- for super senior citizen is also not allowed under new tax regime.

- Set-off / carry forward of any loss of above is also not allowed.

- Adjustment of House property loss from other income heads is also not allowed.

Following deductions/exemption are kept allowed in New Tax regime for FY 2023-24-

- Standard deduction from salary for Rs. 50000/-

- Deduction for family pension u/s 57(iia)

- Transport allowance exemption for disabled employee.

- Conveyance & daily allowance exemption.

- Deduction u/s 80JJAA

- NPS u/s 80CCD(2) Employer contribution to NPS.

- Rebate u/s 87A is increased for taxable income upto Rs. 700000/- from Rs. 500000/- only for assessee who are in new tax regime.

- Surcharge is restricted to 25% for income above 2cr. only for assesee in new tax regime.

A brief comparison of the new & old tax regimes for FY 2023-24 is given in the image.. If the benefit which we have to let go to join the new scheme is more than the equalization factor given above, then the old scheme may be beneficial But if it is less than the equalisation factor then the new scheme is beneficial.