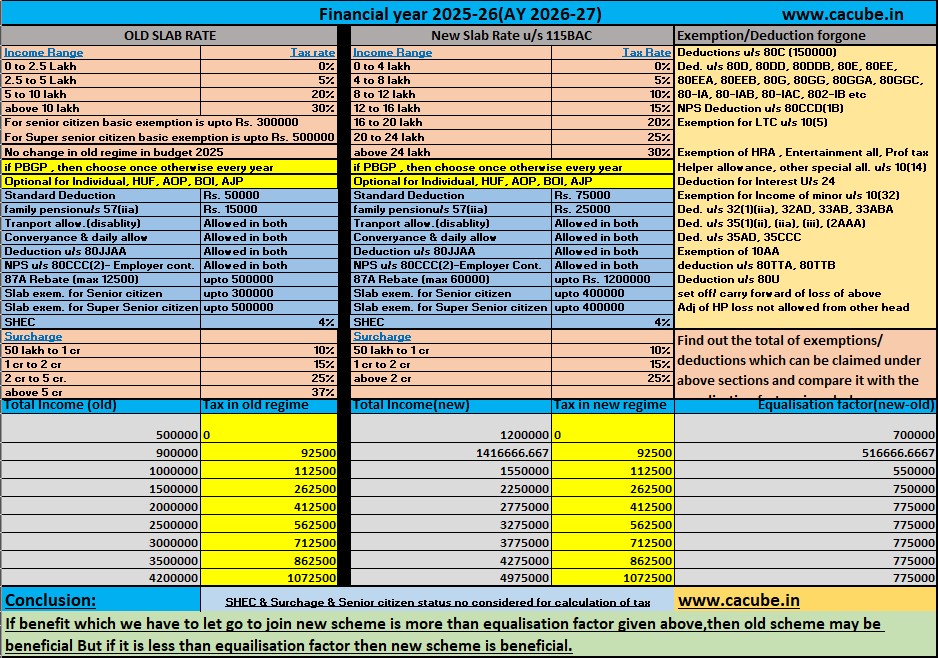

A comparison of tax under Old Tax Regime Vs New Tax Regime for FY 2025-26 (AY 2026-27) with equalisation factor is shown in image.

Step-1, compute the value of your application exemptions and deductions which you can claim in old tax regime but need to forgo is choose new tax regime.

Step-2 , compare the value arrived in step-1 with equalisation factor as shown in image for your income level.

Step-3 If value in step 1 is greater than equalisation factor = old tax regime may be beneficial.

If value in step 1 is less than equalisation factor = New tax regime may be beneficial.

note – 1. only for income below surcharge level i.e. 50lakh 2. EC, SHEC & surcharge not considered.

Before final decision , Check your tax value in both regime with tax calculator at Click Here for tax Calculator