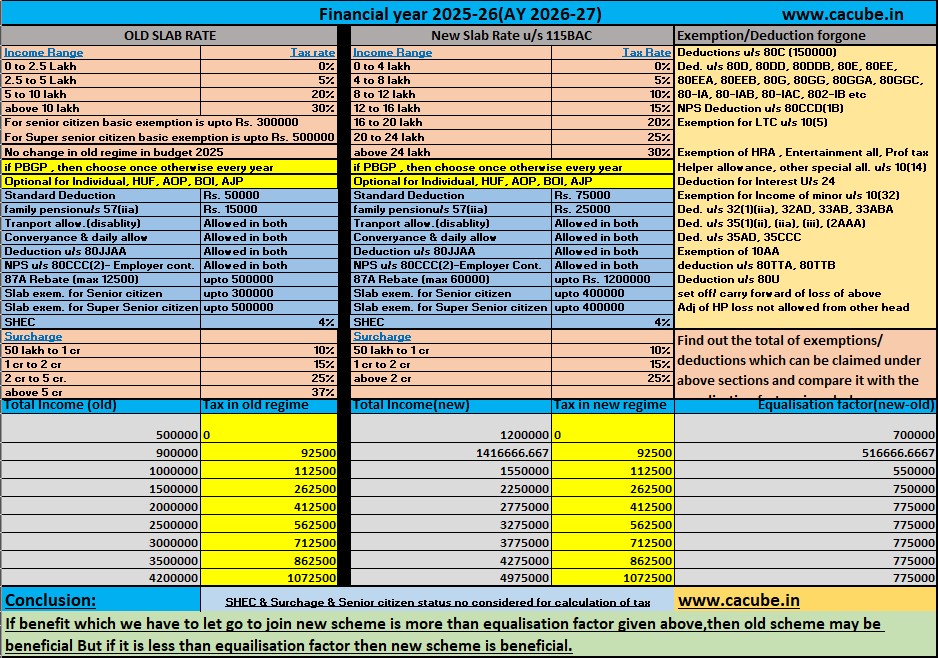

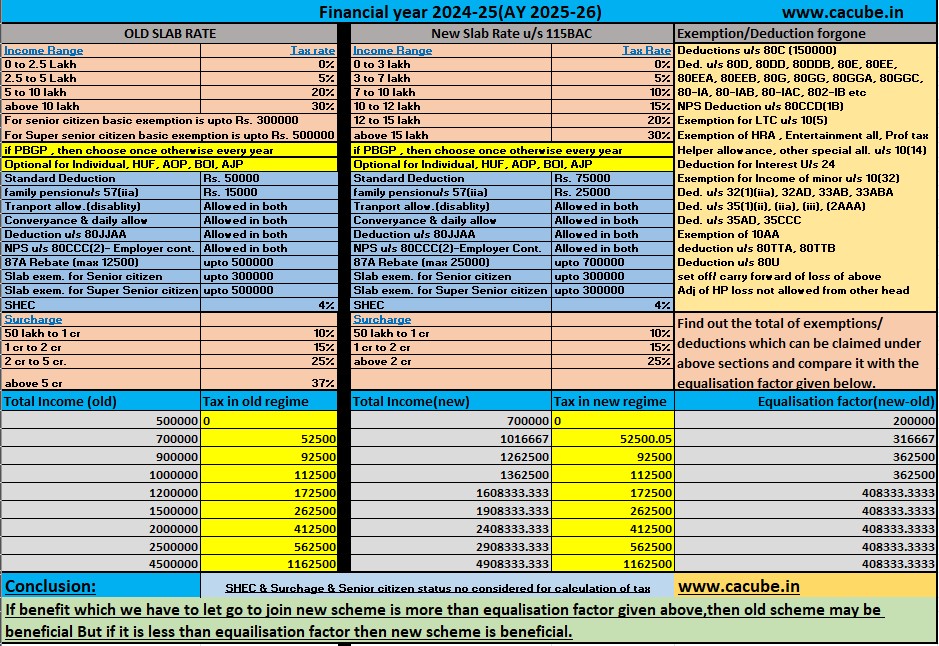

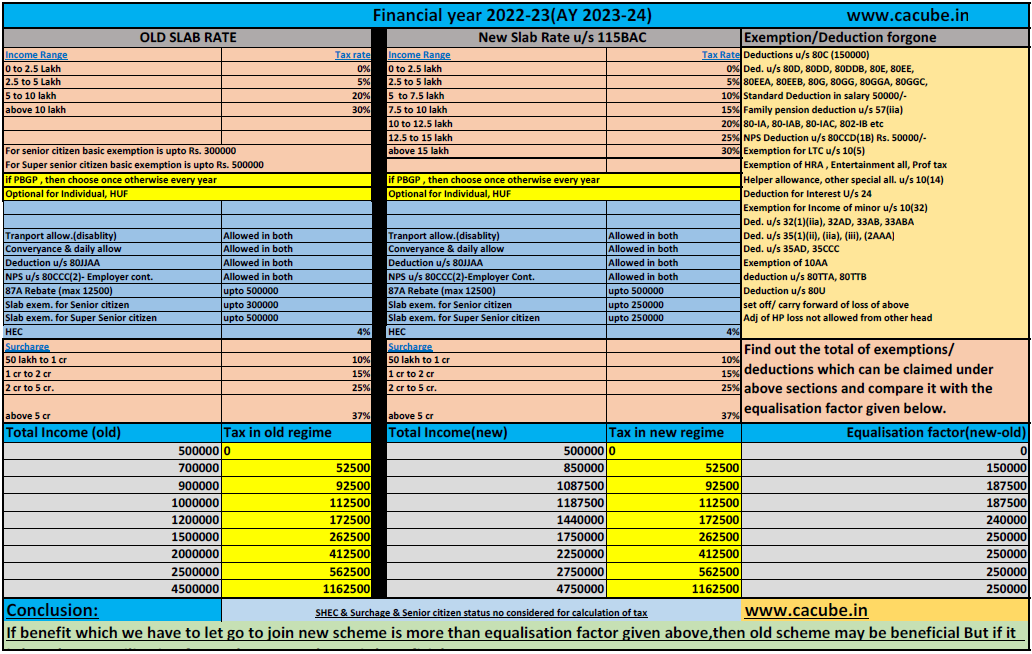

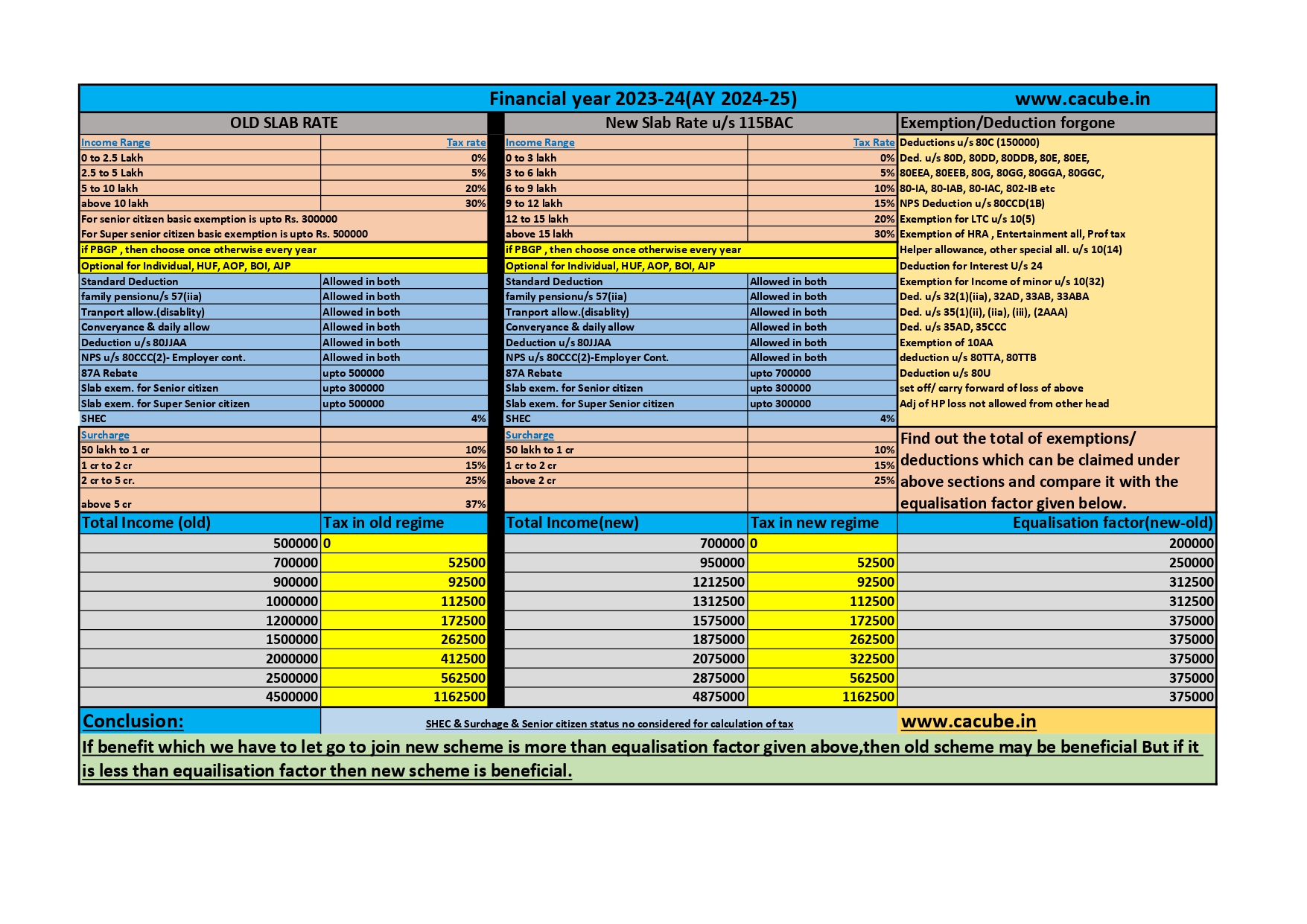

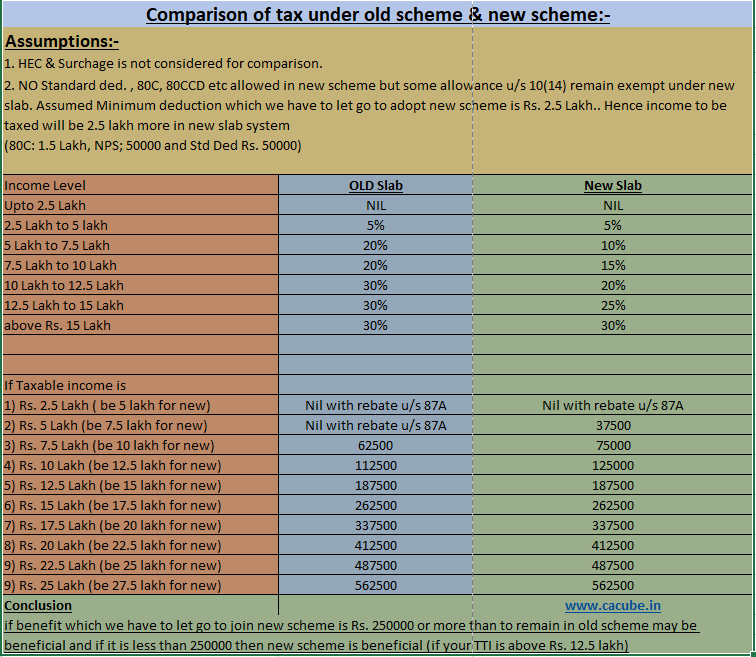

Have you done tax planning for FY 2024-25 before the deadline 31st March 2025?- Checkout what you missed.

Financial year 2024-25 is reaching its end in a few days. 31st March is an important deadline with reference to Financial Planning and Tax Planning, missing it may result in higher tax liability. We are required to complete our tax planning before 31st march 2025, as we are required to file Income tax return for […]

Continue Reading