Many people filing income tax return for the financial year 2022-23 and worried about tax regime.

Please note that-

- New tax regime is available only for Individual & HUF.

- Slab rates under New Tax regime are not differentiated on the basis of age group. Hence in new slab rate, same rate will be applied for individual aged above 60 or below 60 or above 80.

- Whether this OPTION is exercised only once or Every year:– If assessee is having no business income then this option shall be exercised in every coming year. But If assessee has business income, then option once exercised shall be valid for current & subsequent previous years.

- Slab rate under New Tax regime are lesser than Old tax regime.

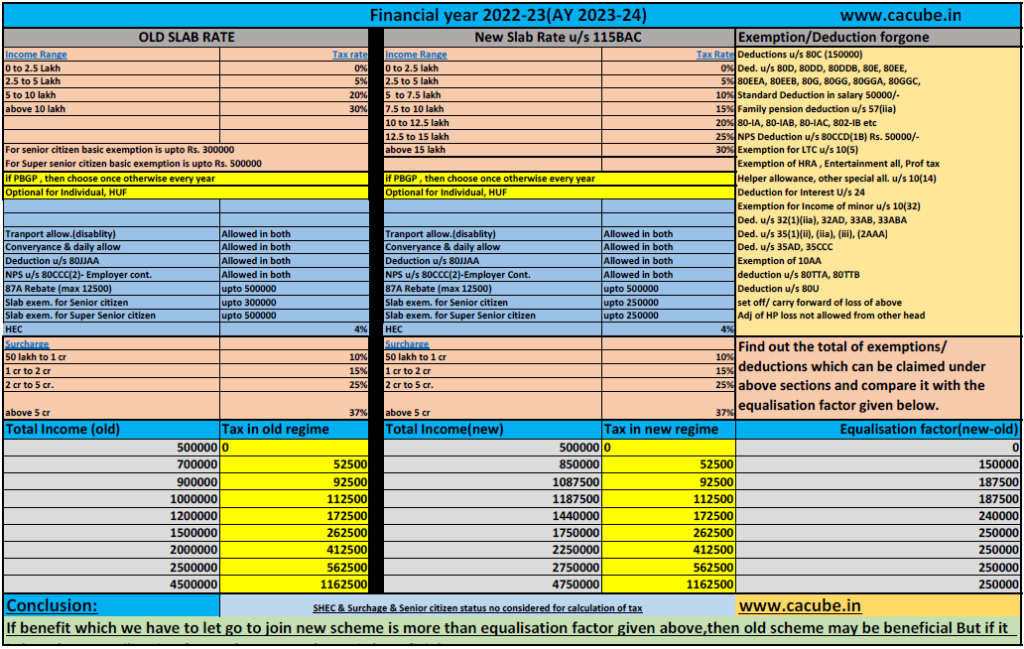

- but If a tax payer opt for this new slab rate then he has to forego various deduction and exemption like deduction u/s 80C, standard deduction, NPS deduction u/s 80CCD(1b) but he may continue to avail exemption of allowance given under section 10(14) like conveyance allowance etc.

SLAB RATE UNDER NEW TAX Regime u/s 115BAC for FY 2022-23

Following tax rates will be applicable for Individual & HUF who opted for NEW TAX REGIME for financial year 2022-23 (assessment year 2023-24):-

| Total Income | Rate of tax |

| Up to Rs. 2,50,000 | Nil |

| From Rs. 2,50,001 to Rs. 5,00,000 | 5% |

| From Rs. 5,00,001 to Rs. 7,50,000 | 10% |

| From Rs. 7,50,001 to Rs. 10,00,000 | 15% |

| From Rs. 10,00,001 to Rs. 12,50,000 | 20% |

| From Rs. 12,50,001 to Rs. 15,00,000 | 25% |

| Above Rs. 15,00,000 | 30% |

But If option given under 115BAC is exercised to choose New Slab rate (Option A ) then following deduction & exemption shall not be available to the taxpayers for FY 2022-23:-

- Leave travel concession as contained in clause (5) of section 10;

- House rent allowance as contained in clause (13A) of section 10;

- Some of the allowance as contained in clause (14) of section 10;

- Allowances to MPs/MLAs as contained in clause (17) of section 10;

- Allowance for income of minor as contained in clause (32) of section 10;

- Exemption for SEZ unit contained in section 10AA;

- Standard deduction, deduction for entertainment allowance and employment/professional tax as contained in section 16; (it is made allowed in new tax regime form FY 2023-24 but not allowed in FY 2022-23)

- Deduction for family pension u/s 57(iia) ((it is made allowed in new tax regime form FY 2023-24 but not allowed in FY 2022-23)

- Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

- Additional deprecation under clause (iia) of sub-section (1) of section 32;

- Deductions under section 32AD, 33AB, 33ABA;

- Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35;

- Deduction under section 35AD or section 35CCC;

- Deduction from family pension under clause (iia) of section 57;

- Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc). However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

- Set off of any loss,-carried forward or depreciation from any earlier assessment year, if such loss or depreciation is attributable to any of the deductions referred to in (a) above; or under the head house property with any other head of income; is not allowed.

BUT following allowances notified under section 10(14) of the Act to remain allowed to the Individual or HUF exercising option of NEW SLAB RATE (option A) under the proposed section:-

- Transport Allowance granted to a divyang employee to meet expenditure for the purpose of commuting between place of residence and place of duty

- Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

- Any Allowance granted to meet the cost of travel on tour or on transfer;

- Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

- deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment).

SLAB RATE UNDER OLD tax Regime for FY 2022-23

| Net income range | Income-Tax rate |

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001- Rs. 5,00,000 | 5% |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

2. Basic exemption limit for senior citizen is 300000/- and for super senior citizen is 500000/-. But now benefit for senior citizen in New tax regime.

(11) Hence assessee is required to choose between old & new slab rates. Different decision may be useful for different assessees. Before taking any decision assessee should calculate his tax liability under both the options predicting his approximate income and then he has to choose the option in which his tax liability is less. A basic comparison of OLD & NEW tax regime is given here:-

You need to calculate the value of these exemption and deduction which are applicable in your case and which you are eligible to claim if you file ITR in old tax regime. But if you file ITR in new tax regime then you have to forgo these exemptions & deductions. So find out the exemptions forgone to opt new tax regime.Please note that tax on 1200000/- in old tax regime is equal to tax on 1440000/- in new tax regime Hence

equalization factor is (1440000-1200000) i.e. 240000/- in your case.

Thus if the value of deductions & exemption which are required to be forgone is more than 240000/- then old scheme is beneficial but if your deductions & exemption’s value is less than 240000/- then new scheme is beneficial. Equalisation factor at different level of income are given in above table.