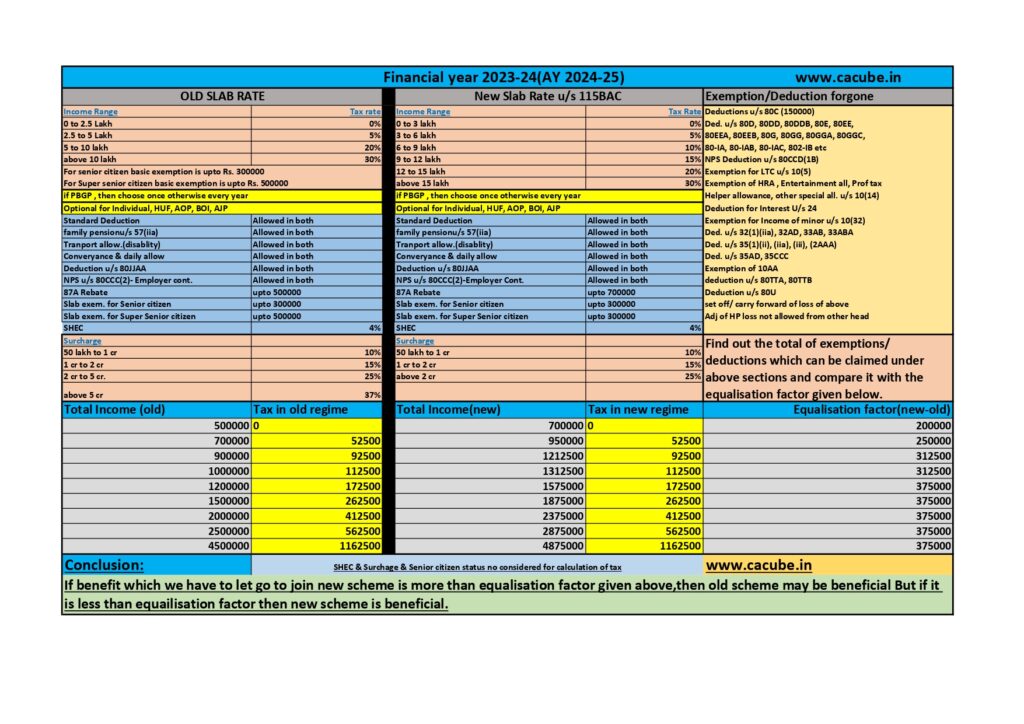

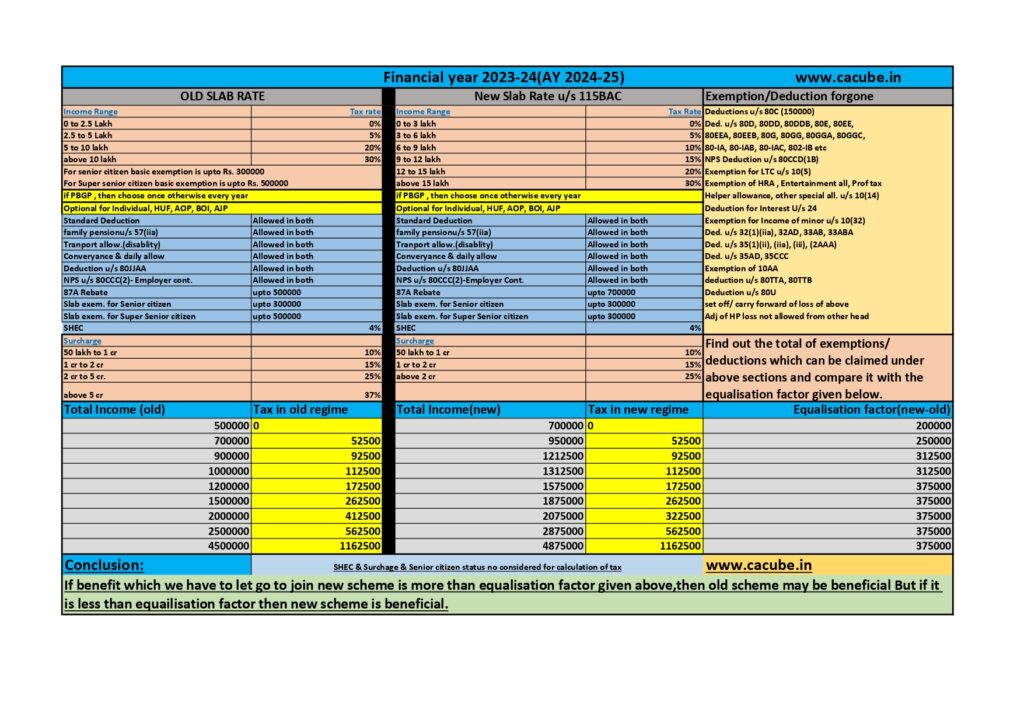

Have you done tax planning for FY 2023-24 before the deadline 31st March 2024?- Checkout what you missed.

Financial year 2023-24 is reaching its end in a few days. 31st March is an important deadline with reference to Financial Planning and Tax Planning, missing it may result in higher tax liability. We are required to complete our tax planning before 31st march 2024, as we are required to file Income tax return for […]